Over the next month or two, continue to track your spending to see where most of your money goes. Miscellaneous expenses that aren't necessarily paid monthly can become a miscellaneous category, for example.

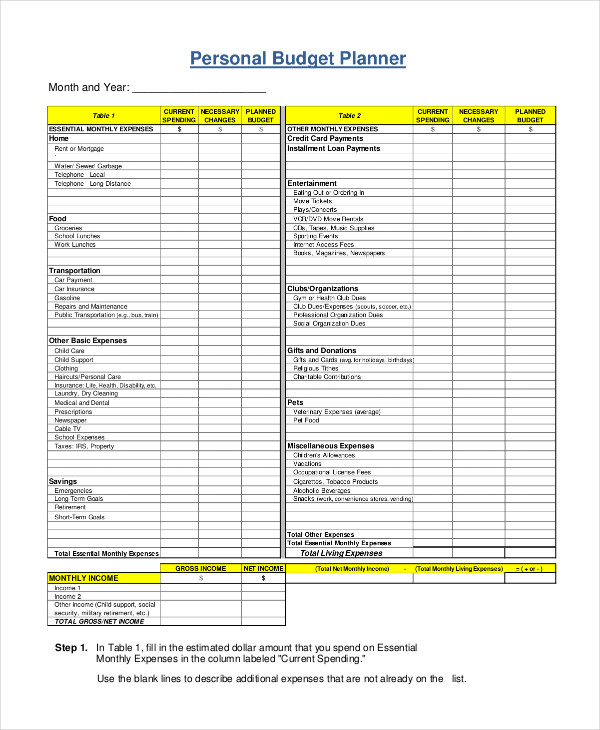

When you create your budget, each budget category will have a specific amount to spend. List out all of the expenses you've had over the past 3-6 months, adding them to a budget category, like groceries, utilities, and car payments. Net income includes any money you make after business expenses and taxes, so this is the money that you'll have available for your budget. Remember only to include your net income rather than your gross income. However, it could take a little more work if you have irregular income, such as from a business or real estate properties. If you have only one job as an employee, this should be easy to do using pay stubs. Remember to include how much you put into your savings every week or month. Go through your bank records and print your expenses for the past 3-6 months so that you can be sure to account for all expenses in your budget.

Then, make copies of all the bills you pay each month. Gather documents that show report your income, such as pay stubs, tax documents, or 1099s. Start by collecting the financial documents you need to get an accurate picture of your financial health. However, having a general idea of the steps to take when making one can ensure that you don't miss anything important along the way.

8 STEPS TO CREATING A PERSONAL BUDGET HOW TO

There is no right or wrong way to budget, so it's always possible to learn how to make a budget that fits your finances. Whether you want to learn how to get out of debt or need to figure out how to have extra money for groceries each month, a personal budget can help. It breaks down all of your income into goal-backed categories, allowing you to save and spend as needed. When you have a plan in place for your income, you can more easily see where your money goes each month and the importance of being mindful of your spending. You can also make room for an emergency fund, payments on student loans, vacation savings, and any other financial goal that's important to you. Through your budget, you'll plan for fixed expenses, variable expenses, credit card payments, saving goals, and discretionary spending. What Is a Personal Budget?Ī personal budget is the backbone of a personal finance strategy, which is the financial management process that keeps track of your income, expenses, bills, and savings.Ĭreating a personal budget is essential for financial health because it designs a clear plan for your money. Plus, there are several types of spending plan options and budgets to choose from that can make a difference to your bank account and personal finance goals. Learning how to make a budget might seem elementary, but you might be surprised to learn how important each step is to the process.

This lack of budgeting and clear financial goals can lead to debt and dings to your credit score. If you spend money without glancing at your checking account from time to time, you may end up spending more than you have available. It's easy to learn how to make a budget when you break down the process into actionable steps.īalancing your income and expenses can be challenging without a plan in place. With a personal budget, you track your income, spending, bills, and debt to help you move toward a healthier financial future. A personal budget can get you several steps closer to your financial goals, like lowering monthly expenses, boosting your savings account, and putting money aside for unexpected expenses.

0 kommentar(er)

0 kommentar(er)